does tesla model y qualify for federal tax credit

1 day agoTesla Model 3 and Model Y Both US-made Model 3 sedans and Model Y SUVs the top selling EVs in America would qualify for the tax credit following passage a boost for the brand because Tesla is. Internal Revenue Code Section 179 Deduction allows you to expense up to 25000 on VehiclesOne year that are between 6000 Pounds and 14000 Pounds or More in the year they are placed in service.

Why You Should And Shouldn T Buy The Tesla Model Y

Any vehicles purchased after that date are no longer eligible for the Federal credit due to the number of vehicles manufactured.

. If youre wondering why no Teslas or the GMC Hummer EV are included its because GM and Tesla vehicles are no longer eligible for the federal tax credit. The Plug-in Electric Drive Motor Vehicle Credit electric car tax credit is a short-term incentive to offset the initial higher purchase price of qualified vehicles. The Tesla Team August 10 2018.

All versions of the Model Y would qualifyAll versions of the Model S and Model X would NOT qualify 3. Since Tesla Model Y is less than 6000 pounds maximum section 179 deduction for Model Y is 10100. To qualify for the Federal Tax Credit in a particular year the eligible solar equipment must be.

However that depends on where. The best-selling electric sedan Teslas Model. The exclusion of Chinese-made EVs from the tax credit is a blow to.

When a manufacturer sells its 200. Tesla buyers that are looking to offset the price of their car should know that the 7500 federal EV. Last month Tesla sold its 200000th such vehicle and since.

Since 2010 anyone purchasing a qualified electric vehicle including any new Tesla model has been eligible to receive a 7500 federal tax credit. According to Electrek the Tesla Model Y Long Range is 9000 more than it was at the start of 2021. Why is Teslas lineup no longer eligible and which manufacturers still receive tax credits.

The rate is currently set at 26 in 2022 and 22 in 2023. Since 2010 anyone purchasing a qualified electric vehicle including any new Tesla model has been eligible to receive a 7500 federal tax credit. So based on the date of your purchase TurboTax is correct stating that the credit is not available for your vehicle.

Only EVs that cost up to 55000 and the SUVs pickup trucks or vans with a price equal to or inferior to 80000 can pocket the 7500 from the federal government. Updated 7292022 Latest changes are in bold Other tax credits available for electric vehicle owners. Both US-made Model 3 sedans and Model Y SUVs the top selling EVs in America would qualify for the tax credit following passage a boost for the brand because Tesla.

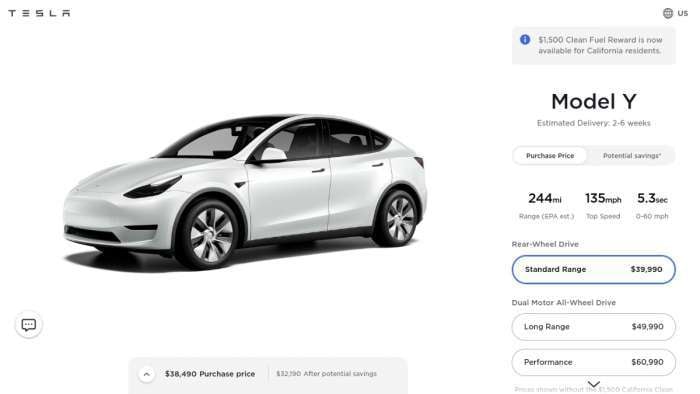

S Model Y SUV which is currently the top-selling EV in the US starts at 65990. The Federal Tax Credit will apply to the cost of the solar portion of Solar Roof as well as the cost of Powerwall. Posted on May 18 2017.

Currently Teslas are not eligible for any federal EV tax credits but they qualify for state tax incentives. Technically the base Model 3 and both versions of the Model Y should qualify with the new MSRP price limit as long as the Model Y is officially considered an SUV. Unfortunately Tesla vehicles are no longer eligible for this perk.

Some plug-in hybrid vehicles will also continue to. Since this credit equally applies to all EV car makers this credit would help equally and not be unfairly biased against Tesla. So now you should know if your vehicle does in fact qualify for a federal tax credit and.

Tesla Model 3 and Model Y. This tax credit begins to phase out once a manufacturer has sold 200000 qualifying vehicles in the US. If you act quickly the Ford Mustang Mach-E and Volkswagen ID4 are still eligible for the full credit.

The Federal tax credit for Tesla vehicles was phased out to zero at the end of 2019. Aspiring Tesla owners should pay close attention. The federal EV tax credit is the first to run out for electric carmaker Tesla on Dec.

A 2500 credit for used EVs could help the used Tesla car market. Tesla Model Y 179 Deduction. This federal tax credit ranges from 2500 to 7500 for qualified electric vehicles that draw energy from a battery.

This tax credit begins to phase out once a manufacturer has sold 200000 qualifying vehicles in the US. New electric and fuel-cell vehicles will get a tax credit up to 7500. EV Tax Credit Details in the Inflation Reduction Act.

One of the incentives for buying an electric vehicle is the federal tax credit. By 2020 the subsidy will be zero dollars for Tesla. The incentive amount is equivalent to a percentage of the eligible costs.

Tesla Tsla Becomes World S Most Valuable Automaker Hits 1 000 Per Share Tesla Model Tesla Tesla Model S

Proposed 15 000 Ev Tax Credit Would Tesla Benefit Torque News

Tesla Model 3 Tax Write Off 2021 2022 Best Tax Deduction

Tesla Cuts Model 3 Y Prices As New Federal Tax Rebate Makes Customers Delay Their Purchases Torque News

Hyundai Ioniq 5 Vs Tesla Model 3 Here S How The Two Evs Compare Films News Feed

Tesla Model 3 Y Axed From Cvrp Rebate After Price Hikes From Inflation Pressure

Tesla Model Y Car Insurance Cost Forbes Advisor

2022 Tesla Model Y Reviews Specs Photos Autoblog

Tesla Drastically Accelerates Model Y Delivery Timeline What Is Happening Tesla Acceleration Tesla Update

Almost Every Tesla Is More Expensive Now News Cars Com

Tesla Range Deliveries Green Lights Toyota Ev News July 8 2022

2021 Tesla Model Y Review Autotrader

2022 Tesla Model Y Performance Vs 2022 Bmw Ix

2023 Tesla Model Y Specs And Features For The Best Selling Ev